Post by Tina L. Saitone, Cooperative Extension Specialist in Livestock and Rangeland Economics

Highlights

- How will changes in consumer buying patterns impact wholesale beef prices?

Spikes in consumer grocery purchases caused wholesale beef prices to rise rapidly; moderating more recently as grocery retailers have restocked and schools and food service operations have shuttered.

- Are beef packers using their market power and this black swan event to take advantage of cattle producers?

There is no evidence this is occurring; packers increased their slaughter volumes and simultaneously paid producers premiums for the fed cattle they procured.

- Why are wholesale beef prices increasing while live cattle prices are falling?

Beef prices and cattle prices are correlated over longer periods of time; prices for calves and yearlings today are more influenced by buyer expectations than current beef prices.

- If beef packing plants are temporarily shut down due to employee heath concerns, how will that impact beef and cattle prices?

Past events suggest that the closure of an individual packing plant will cause temporary market-wide disruptions, increasing wholesale beef prices and causing live cattle prices to fall.

In this installment …

Among the myriad of concerns surrounding the global COVID-19 pandemic is unease about the performance of the U.S. food supply chain. As grocery outlets and their suppliers and distributors struggle to keep food on the shelves, farmers and processors upstream are confronted with the challenge of pivoting away from conventional foodservice and restaurant product offerings, toward product forms that are accessible and desirable for at-home consumption.

The beef industry exemplifies these concerns. The recent pricing patterns and market dynamics observed in the industry have stimulated a lot of discussion about what the future holds. In this blog I discuss the short-term demand impacts and how these changes have influenced beef prices, as well as a variety of factors that are likely to impact the supply side of the beef market. Many researchers and analysts have been considering these topics from a variety of angles. I endeavor here to bring that information together in a comprehensive assessment and separate fact from fiction.

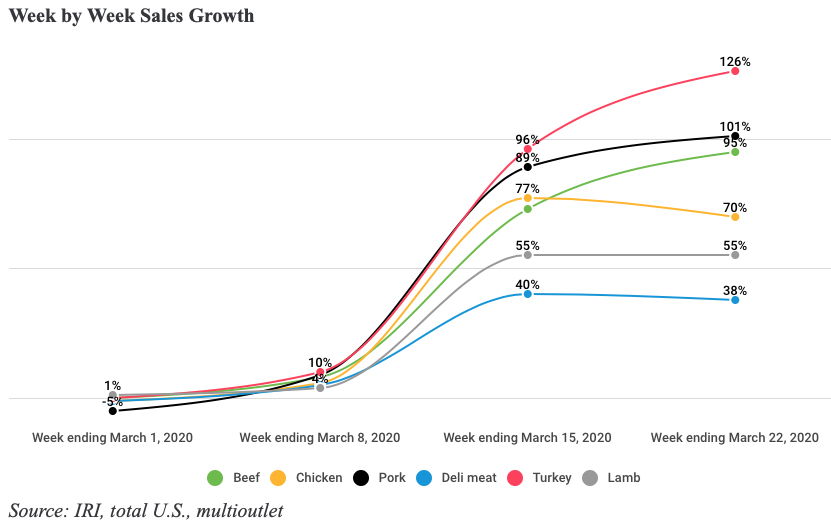

Changes in Consumer Buying Patterns – With the majority of states under “shelter in place” orders, there have been incredible spikes in grocery store sales across the nation. The figure below, from Winsight Grocery Business, shows the percentage change in sales of major meat categories, sold in supermarkets, compared to the same week in 2019. Beef sales (week ending March 22, 2020) were up 95%, relative to the same week last year.

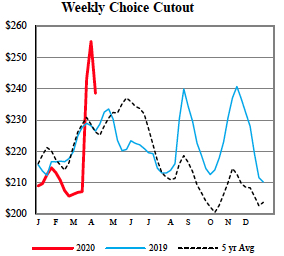

The majority of beef sold at retail (i.e., through grocery stores and super centers) is graded USDA Choice or Select; beef graded USDA Prime is primarily consumed in restaurants. The short-term increase in demand for beef at retail, in the latter half of March following many of the statewide shelter-in-place orders, is consistent with the price surge observed for Choice and Select boxed beef cutout prices (i.e., the gross value of a beef carcass based on FOB prices paid for individual beef items derived from the carcass). Below is a graph (from the USDA Livestock, Poultry and Grain Marketing News) of the weekly Choice Cutout Value (measured in $/hundredweight) (in red). The initial price spike (an increase of nearly $46/cwt. weekending March 20) has started to moderate as the demand from food service has dwindled and grocery outlets have been able to restock.

These unprecedented increases in food purchases via grocery stores and supercenters were largely precipitated by the forced closures of restaurants and schools; eliminating consumers’ ability to consume food away from home. The question food industry leaders are seeking to answer is: will increases in food spending for at-home consumption compensate for the reductions in food-away-from-home spending. Just a few days ago, Rabobank released a report estimating that a 10% decrease in away-from-home food spending would result in an increase in retail food spending of 3%. Yet this estimated tradeoff needs to considered in light of the fact that the costs associated with consumption away from home are likely higher due to labor and infrastructure costs associated with the provision food consumption in restaurants and food service operations. The question that everyone is waiting to have answered is: do people consume more beef when they eat at home or away from home?

Another related consideration, on the supply side, is how quickly will beef packers be able to pivot their restaurant products (e.g., cuts, packaging, etc.) to products that are attractive to consumers at retail. Many news outlets, including the New York Times, continue to remind us that there is “plenty of food in the country,” but the challenge is allocation of products and distribution.

Cattle Supplies and Beef Processing – While beef prices at the wholesale level have increased in response to short-term demand increases, cash prices for calves and feeder cattle have declined. This inverse relationship has caused some to question if beef packers are using market power to suppress prices they are paying for fed cattle (e.g., Crosby). While it is obviously in each beef packers’ self interest to procure fed cattle at the lowest possible prices, it is not viable in the long run because if cattle feeders are driven out of business, they will leave processors without adequate supply. In furtherance of preserving their relationship with the feeders that supply fed cattle, Tyson and Cargill (two of the four largest processors in the U.S. that process roughly 85% of beef cattle) announced they would pay a one-time premium for cattle slaughtered the week of March 20 to help ensure supplies to their operations. While Cargill’s premium wasn’t available, reports indicate that Tyson paid producers $5/cwt. live weight.

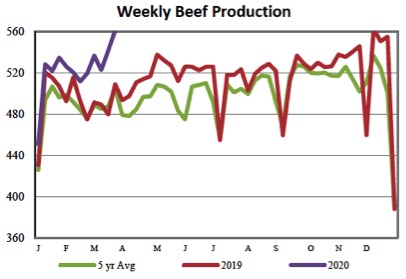

Beef processors also increased their slaughter volumes week-over-week at the end of March (see graph below from USDA Livestock, Poultry and Grain Market News). This increase in production also runs counter to the argument that processors are exercising their market power to suppress prices. Under this theory of market (i.e., monopsony) power, processors would reduce their production.

A major fear among analysts and cattle producers is that one or more processing plants will “go down” due to a significant number of employees contracting COVID-19. Many are using the fire that shuddered a Tyson beef packing plant in August 2019 as a harbinger of the impacts that would likely manifest in beef markets. In the weeks following the fire, boxed beef values increased substantially ($23.83/cwt. increase in two weeks) while fed cattle and feeder prices dropped significantly. The increase in packer margins during the early days following the fire incentivized other packers to increase the amount of cattle they slaughtered, often by adding extra shifts and moving cattle across plants. I would anticipate that this response would happen again if significant processing plant closures occur doe to COVID-related closures.

A possible omen from another animal-processing industry is Sanderson Farms’ announcement that they would preemptively close their Moultrie, Georgia broiler processing plant, despite no documented COVID-related illnesses, reducing the number of chickens slaughtered by 1 – 1.3 million over the next month. Plants going offline, even temporarily, will have regional impacts and create more macro uncertainty in cattle markets. Late yesterday (April 6) Tyson announced that they would be suspending operations at two of their pork processing plants in Iowa. Also yesterday, JBS announced that health officials in Colorado and Nebraska were investigating concerns about some employees testing positive for COVID-19.

Something we must all remember is that prices of calves and feeder cattle and beef prices are correlated but over a longer period of time. This is because calves and yearlings being raised right now, won’t hit the slaughter floor for months or maybe a year. So calf and feeder prices today will not be directly influenced by wholesale beef cutout prices today; rather those live cattle prices are more influenced by expectations about future beef demand. These expectations about the future took a big hit when this global health crisis came to the forefront of our collective consciousness. Also, long before COVID-19, projections indicated we were headed for record meat and poultry production, with beef production slowing by only 1% compared to 2019. The anticipation of large supplies of meat and poultry production would, absent the current crisis, have had a moderating affect on live cattle prices.

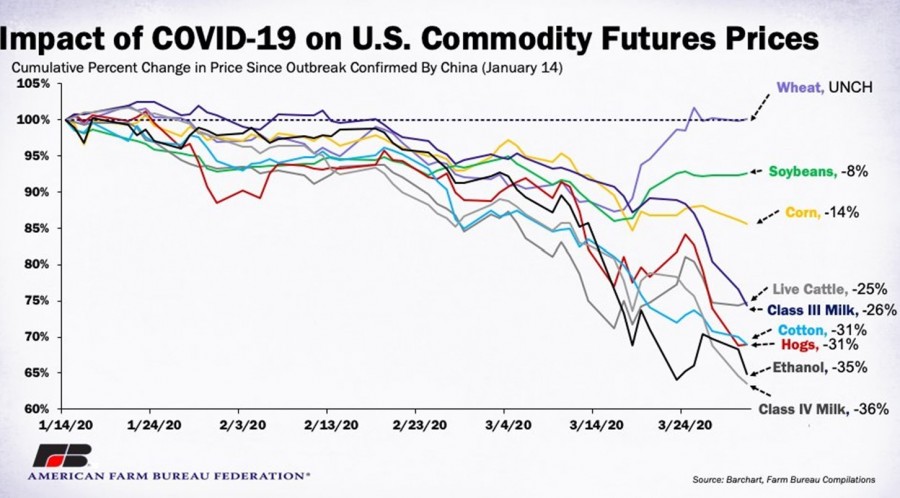

Following the retail demand surge, the futures prices for many agricultural products declined rapidly. In the figure below, generated by the American Farm Bureau Federation, the cumulative percentage change in the commodity futures price is shown since the COVID-19 outbreak was confirmed in China (Jan 14, 2020). The live cattle futures price declined by 25% during this period, which is likely more reflective of the concern and predictions that COVID-19 will push the U.S. economy into a recession. If recession does hit, beef being a higher priced animal-based protein is typically hit hard by demand reductions (i.e., it is more sensitive to changes in income than other, lower priced animal-based proteins).

In summary, I disagree with those suggesting that the beef market is “broken.” Instead I would characterize the beef supply chain as operating very efficiently and responding quickly to the black swan event that is the COVID-19 pandemic.